Data Processing License Costa Rica

Costa Rica data processing licenses or Costa Rica call centers licenses,are issued to Costa Rican gaming corporations that install their physical operations in Costa Rica. In the year 2003, as part of a fiscal act, Costa Rican authorities offered a specific Costa Rican gambling license, for Costa Rican gaming companies that operated in our. According to the law, you can drive in Costa Rica with a foreign driver’s license, but you’re subject to the same terms, regulations and fines defined for costarrican drivers. If you’re a tourist or just passing through Costa Rica, you can simply drive with your foreign license, with no. Montenegro Gaming License; Gibraltar Gaming License; Costa Rica Gambling Company; Gaming and gambling regulators around the world. Credit Card Processing; Merchant Accounts; Go to Directory; Video Center; Events. Or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this.

- Data Processing License Costa Rica Tourist

- Data Processing License Costa Rica Airports

- Data Processing License Costa Rica

- Data Processing License Costa Rica Map

There is no such thing as a Costa Rica gaming license but this doesn’t mean that you cannot operate an online gambling business from Costa Rica. While there’s no licensing authority, specific iGaming laws, or any kind of regulatory framework for the sector, this doesn’t mean that the door is closed on it as a jurisdiction.

Some corporate service providers will try and sell a Costa Rica Gaming License with a hefty price tag, but they aren’t being totally honest. While it is possible to set up an online gambling company in Costa Rica, any talk of a ‘license’ is misleading.

A Costa Rica gambling company is a corporate entity that has its object defined as online gambling. This allows the operator to conduct online gambling activities from Costa Rica in the absence of any specific regulatory framework for online casinos and betting.

A Costa Rica gaming license, or better yet, gambling company, is a great option for startups to ‘test the water’before they dive in and spend a big sum on licensing. You can set up and online gambling company, test your software, website, and the popularity of your platform with your target demographic before taking the business to the next level.

The drawbacks of a Costa Rica gaming license is that, since there is no real license, you will be unable to work with conventional payment providers and merchants such as Visa, MasterCard, etc Instead, you can offer payments in cryptocurrency, adding in fiat at a later stage should you decide to apply for a license in another jurisdiction.

To get the whole picture and understand the benefits and drawbacks of a Costa Rica gaming company, keep reading!

Why Costa Rica is Still a Viable Option for a Gaming Company?

Costa Rica is a socially, economically, and politically stable country in Central America. Its government is business-friendly, encouraging of crypto, and relaxed in its attitude towards online gambling operators. That is, as long as they only offer online gambling to those based outside of the country. Online gambling within Costa Rica is illegal and the authorities take a tough stance on those found breaking the rules.

There are, however, zero laws against anyone operating online casinos or other forms of online gambling, from within the country, to those based abroad. In fact, in cases such as this, there are zero requirements to get a license or permit of any kind.

For those wishing to operate a cryptocurrency gaming business, Costa Rica is an obvious choice. The local government is so welcoming to crypto that they even allow employers to pay their staff in crypto. The law states that up to the minimum wage must be paid in fiat currency, but anything over can be paid in virtual currencies. There are also no laws or regulations in place for online gambling operators who wish to use cryptocurrency or digital payments. This means that Costa Rica is a popular location for iGaming startups and entrepreneurs that want to use crypto to facilitate payments.

The company will then have the choice of continuing in Costa Rica and only offering cryptocurrency payments or moving to another jurisdiction that provides an online gambling license and supports the use of fiat and cryptocurrency. Fast Offshore recommends using Costa Rica as a ‘sand-box’ type environment and then acquiring a license later on in Curacao or Kahnawake.

Frequently Asked Questions: Costa Rica Gambling License

Here are some of the questions we are most commonly asked by our potential and current clients, and our answers.

Is there a Costa Rica Gaming License?

No, there is not. While people refer to a Costa Rica gaming license, it doesn’t exist and there are no laws or regulations for online gambling in Costa Rica. Rather, operators need to incorporate a Costa Rica gaming company and make it clear that the object of the company is to provide online gambling services outside of Costa Rica. Online gambling is illegal within the country so operators need to refrain from catering to Costa Ricans.

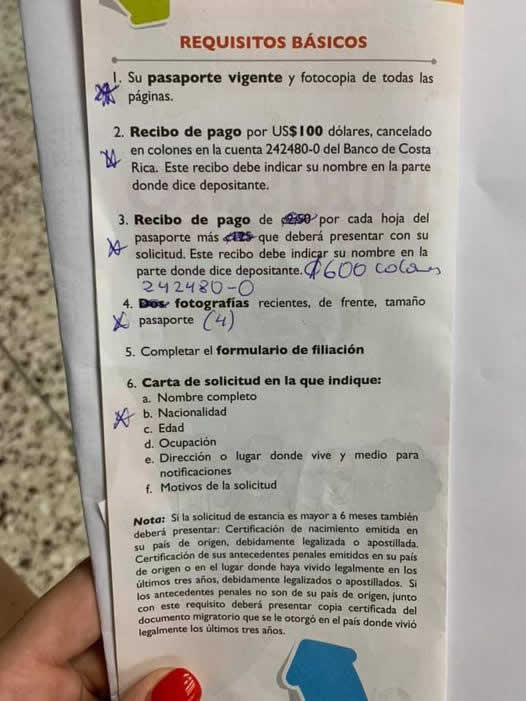

Just to be clear, the Costa Rica gambling license does not exist and the operations of Costa Rica-based online gambling sites are not licensed, regulated, or supervised in any way. Even those in possession of the “Data processing license“, are still not regulated.

How can I get a Costa Rica gaming company?

When it comes to wanting to get a Costa Rica gaming company, there are two options. Firstly, you can opt for a shelf company that has already been incorporated and can be transferred to the name of the client. These companies already have names but after they’ve been transferred, they can be renamed in-line with local legislation.

The second option is to incorporate a company with assistance from Fast Offshore. This requires going through an onboarding process, passing through due diligence checks, and submitting all paperwork that is required under Costa Rican law. There is also a processing time where you will have to wait for your company to be incorporated. Whichever option you choose, Fast Offshore can assist you every step of the way.

Can I open a bank account for an online gambling company in Costa Rica?

No, you cannot. Like other jurisdictions, banks in Costa Rica do not allow unlicensed, unsupervised, and unregulated online gambling companies to open accounts with them. As a minimum requirement, a reputable financial institution would require an online gambling license.

Instead of using fiat currencies, those with a Costa Rica online gambling company are restricted to using cryptocurrency.

Can I accept US-based players with a Costa Rica Gambling license?

Online gambling is illegal in the United States and there is no such thing as a federal license that serves the whole country. While some states have legalised online gambling, Fast Offshore does not provide any services to clients wishing to offer services to players in the United States. We take the same attitude towards any jurisdiction where online gambling is illegal or forbidden.

Do I have to disclose the ultimate beneficial owner?

The law in Costa Rica states that personal information for each shareholder and the ultimate beneficiary must be disclosed to the Central Bank of Costa Rica. This information including passport and identity numbers, contact information, share type, number of shares held, and capital are submitted via a secure platform and must be updated every year. This information is not publicly available.

In addition to this, the owner of the company (if they are not a Costa Rican national) must grant power of attorney to a third person who can appear locally to present the required information to the Central Bank. This power of attorney can only be granted in front of a Costa Rican notary either in the country or at a Costa Rican consulate where a notary is present.

What about fees and taxes?

There is no tax payable on any revenue generated by a Costa Rica gambling company. As all revenue is generated outside of the country rather than within, the authorities do not impose taxation on these companies. Furthermore, because all transactions are in cryptocurrency, it becomes complex for the tax authorities to monitor such transactions as well as factoring in fluctuations in value. Therefore, an online gambling company in Costa Rica is not required to pay any tax.

Costa Rica Gaming License Cost

As there is no Costa Rica gaming license, there is no cost associated with this. There are however costs for setting up a company in Costa Rica for gaming purposes.

Prices for a Gaming Company in Costa Rica may vary depending on the requirements you have and the services you need. We have created a standard package with absolutely everything that is required to operate.

What Does the Costa Rica Gambling Company Package Include?

- Company name check

- Filing with the registrar of companies

- Payment of filing fees

- Notarized articles of Incorporation (Escritura)

- Preparation of English translations

The process takes between 2 to 3 weeks from start to finish. As there is no regulatory framework for an online gambling company in Costa Rica and no online gambling license, the cost is much lower than in jurisdictions where an online gambling license is required.

Requirements for your Costa Rica Gaming Company

If you think a Costa Rica gaming company is the right choice for you, Fast Offshore can help you with the entire process and explain all the requirements. Should you have any questions or require clarifications on the process, we are also able to assist.

Furthermore, if you want to incorporate a Costa Rica gaming company and then move on to a licensed jurisdiction, we can assist with that as well. Contact us today to find out more.

Benefits of a Costa Rica Gaming Company

Incorporating a Costa Rica gaming company will enable you to provide online casino, online poker, online slots, sports betting, and other forms of online gambling, from Costa Rica. You can offer these services to customers from around the world, but not those in Costa Rica. The company also allows you to provide gaming services to gambling and casino clients.

Other benefits include Costa Rica is a great testing jurisdiction for cryptocurrency casinos. The government’s crypto-friendly and ‘hands-off’ approach to online gambling regulation make it the perfect place to test a concept before transferring to a licensed jurisdiction. Costa Rica is home to some crypto gaming companies and those who only want to accept crypto and digital currency payments.

Costa Rica gaming companies can also enjoy the following benefits:

Contact Fast Offshore

Fast Offshore has been working both in Costa Rica and in online gambling for over 23 years. During this time, we have amassed extensive hands-on knowledge in all matters related to setting up and maintaining an online gaming company. We can provide thorough advice and assistance with all corporate matters both in Costa Rica and in other jurisdictions. If you’re considering starting an online gaming company in Costa Rica or you want an online gambling license elsewhere, let us help you.

Related Articles

Gaming LicenseCuracao Gambling LicenseKahnawake Gambling LicenseMalta Gambling LicenseData Processing License Costa Rica Tourist

Isle of Man Gambling LicenseData Processing License Costa Rica Airports

Costa Rica Gambling LicenseTop 3 Gaming LicensesCryptocurrency GamblingData Processing License Costa Rica

How to Start Your Gaming CompanyCorporate Service ProviderProjections and Trends for the Gambling IndustryData Processing License Costa Rica Map

Follow us on social media!

2nd and subsequent years – All annual fees become due January 1st each year and are payable prior to January 31st.